September’s survey results show that farm gate prices are holding firm

Published on : 26 Sep 2024

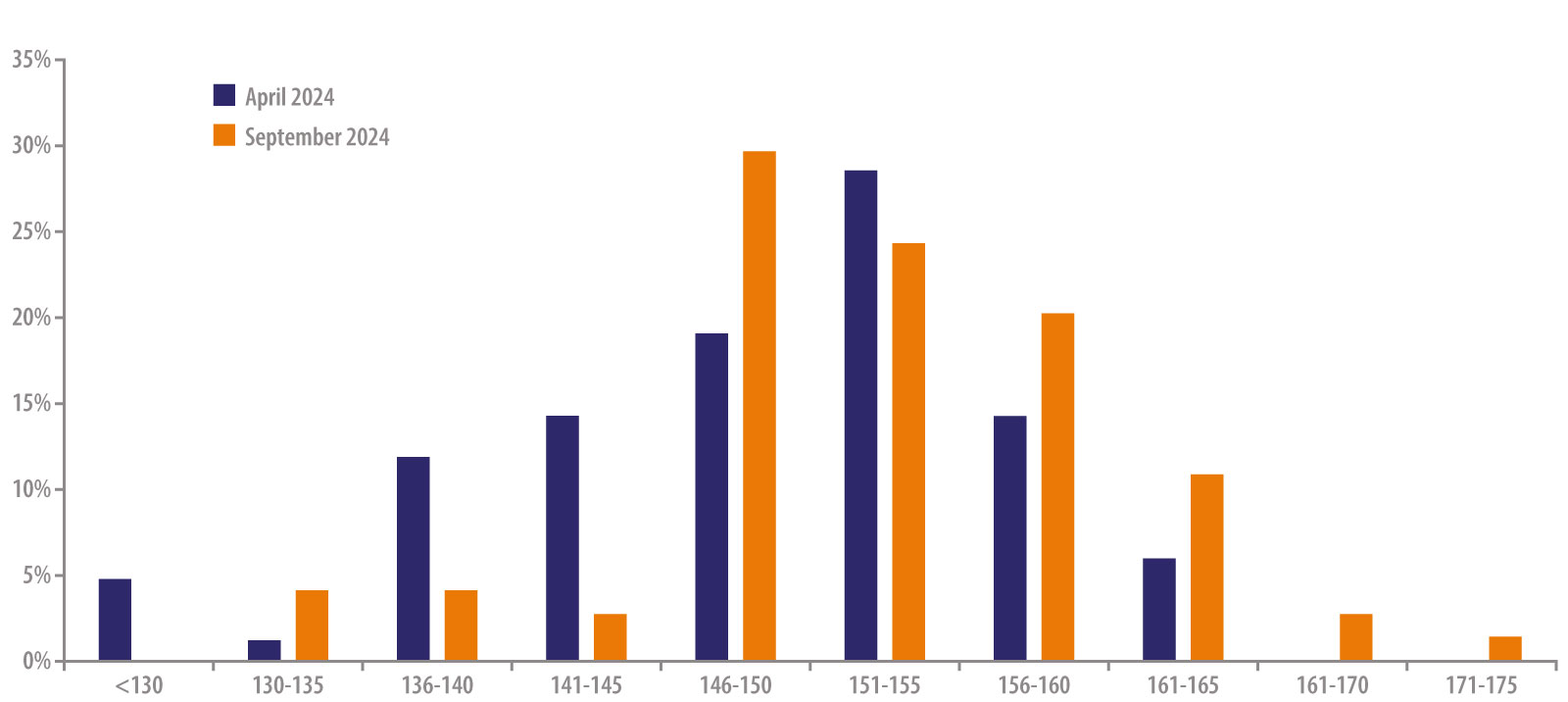

Brown FR Egg Prices (Farm Gate, PPD) - Survey Responses April 2024 vs September 2024

Rumours abound of a weaker wholesale market, heavy inter-packer trading, high levels of export and falling processing prices. BFREPA has reported recently that at least one packer has reduced producer prices for Class B eggs. And yet the prices at farm gate gathered in our latest survey indicate that not only are most producers now receiving more than 150 pence per dozen (ppd) for their eggs, but that the mean average price paid for a brown free range dozen is nearly 5ppd higher than three months ago, now 153.2ppd, up from 148.5ppd when we last polled in July. By comparison, the September ADAS cost of production report indicates an average yield of 152.1ppd. Perhaps most notable is the shift in weighting towards the right of the chart below, indicating a more significant proportion of farmers are receiving prices toward the top of the scale. In July, 68% of farms were returned prices in excess of 146ppd. Today, that percentage has risen to 89%. 10% of responses were generated by producers operating outside of the Lion Code of Practice, including a selection of private individual producer-marketeers and several farms supplying one of three non-Lion ‘independent’ packers. Remarkably, the remaining results represented not less than 25 Lion Code Subscribers (packers), giving the most fragmented dataset yet analysed.

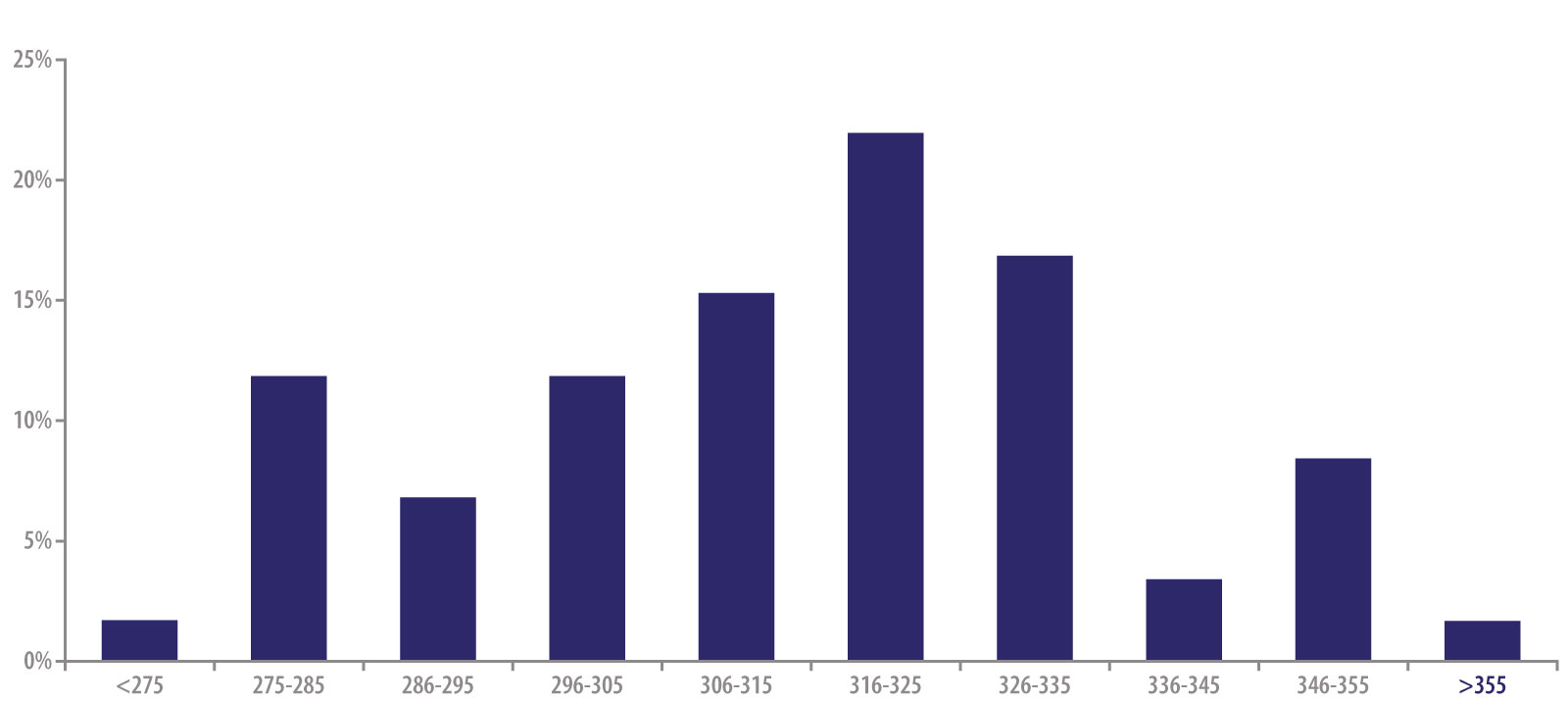

Feed Price - Free Range Brown Eggs - £/t by % respondents in September 2024

Only two businesses had more than six results: Noble Foods and Stonegate. As has been the case in the past, farmers supplying the two largest packers comprised 50% of the submissions. Such market fragmentation impedes meaningful conclusions on important aspects such as relative pricing between competitors or disparity between farms within a single supply chain. Looking only at the big two, there is consistency in their inconsistency. Respondents supplying each reflected a price range of close to 20ppd, with the majority of farms paid within a much narrower band around the mean average. The total marketplace is far more widely spread, and, as was the case in July, a 39ppd range exists between the highest and lowest returns at 172 and 133ppd. Of course, there is much more to outright profitability than egg price, but when the cost of feed (again referring to ADAS) is reported to equate to 57pence in every dozen, the inequality in egg price between some farms is enough to cover more than two-thirds of the ration. The response rate from members this month was lower than previously seen, and several replies had to be expunged due to either indecipherable formats or missing data. The request for feed prices seemed especially problematic, with only 65% of farms providing a figure. Of those that did, the mean feed price reported for free range production was £315/t, with the top and bottom ranges being £380/t and £273/t. Although the range is high, 66% of farms pay prices between £296 and £335, a range more akin to typical life stage, geographic, or forward purchase considerations. Egg Supply Agreements or contracts with full or partial links to the ADAS Cost-of-Production tracker have grown in popularity in the last year. Several retailers now link their pricing to packers using the same reference. Sainsbury’s recently announced its intention to use the model as part of its commitment to always paying farmers above the cost of producing eggs. In the latest survey data, 51% of farmers had some sort of production cost linked with the egg price they received, with 20% of farms reporting benefiting from a link to the full ADAS model by name. Five packers had farms stating that they had ADAS-linked contracts, with Stonegate heavily represented. The topic of white eggs is like marmite, but there’s no denying the growth. 10% of replies came from farms with the lightweight laying machines, supplying a network of seven packers. The average price for whites is slightly lower than brown eggs, at 149ppd. The highest and lowest prices are 137 and 162ppd respectively. As with brown free-range eggs, Noble and Stonegate were prominent in the small number of responses for organic production, accounting for more than 80% of the feedback. Prices range from 228 to 254ppd, averaging 239ppd, markedly higher than the ADAS costing figure of 226ppd. Feed prices averaged £532/t, ranging from £517/t to £570/t. So, much ‘as we were’ this quarter. With murmurings of a softening marketplace, rising flock size and still little clarity on the cage-free commitments in some retailers, it’ll be an interesting few months ahead as we turn to 2025. Kantar data to 1st September provides a stark reminder of how important value is to the consumer. In the last 52 weeks, the retail sales volume grew by 4.7% versus the prior year, but cage volume specifically grew by 13.8%, despite a reduction in the number of fixtures as some supermarkets completed their self-imposed cage-free transition. As a result, the cage egg market share grew to 21.9%, up from 20.1% a year ago.In sharp contrast, organic volume retracted by 22.1% year-on-year, while free range grew by just 2.3%. Organic sales now represent 2.3%, the lowest since 2020, while free range currently accounts for 70.3% of volume sales. Barn sales continue to climb, achieving 5.5% of market share in the last 12 months, up 21% from the previous year.