Holding Steady: What the 2026 Confidence Survey Reveals About UK Egg Production

Published on : 29 Jan 2026

Confidence from egg producers show some concerns on government policy and imports.

Producer confidence in the UK egg sector enters 2026 on a steadier footing than a year earlier, with sentiment improving modestly but decisively across both short and medium term outlooks.While optimism has not translated into a surge of expansion plans, the data suggests a sector that has moved away from retrenchment and towards cautious stability, shaped as much by external pressures as by market fundamentals.The headline confidence scores tell a clear if restrained story. Producers rated their confidence in the egg sector over the next 12 months at an average of just under seven out of ten in 2026, up from the mid sixes recorded the previous year. Confidence over the next three years also strengthened, rising from the mid fives in 2025 to just over six in 2026. These are not dramatic shifts, but they are meaningful in a sector where confidence is typically slow to move and often shaped by long investment cycles rather than short term price signals. Importantly, the median score for the three year outlook rose by a full point, suggesting that improved sentiment is not confined to a small group of particularly optimistic producers, but is more broadly shared across the industry.

In its second year, BFREPA’s Confidence Survey shows a modest rise in producer confidence. The 2026 results (blue) edge ahead of 2025 (orange) for both the 12-month outlook and the three-year view.

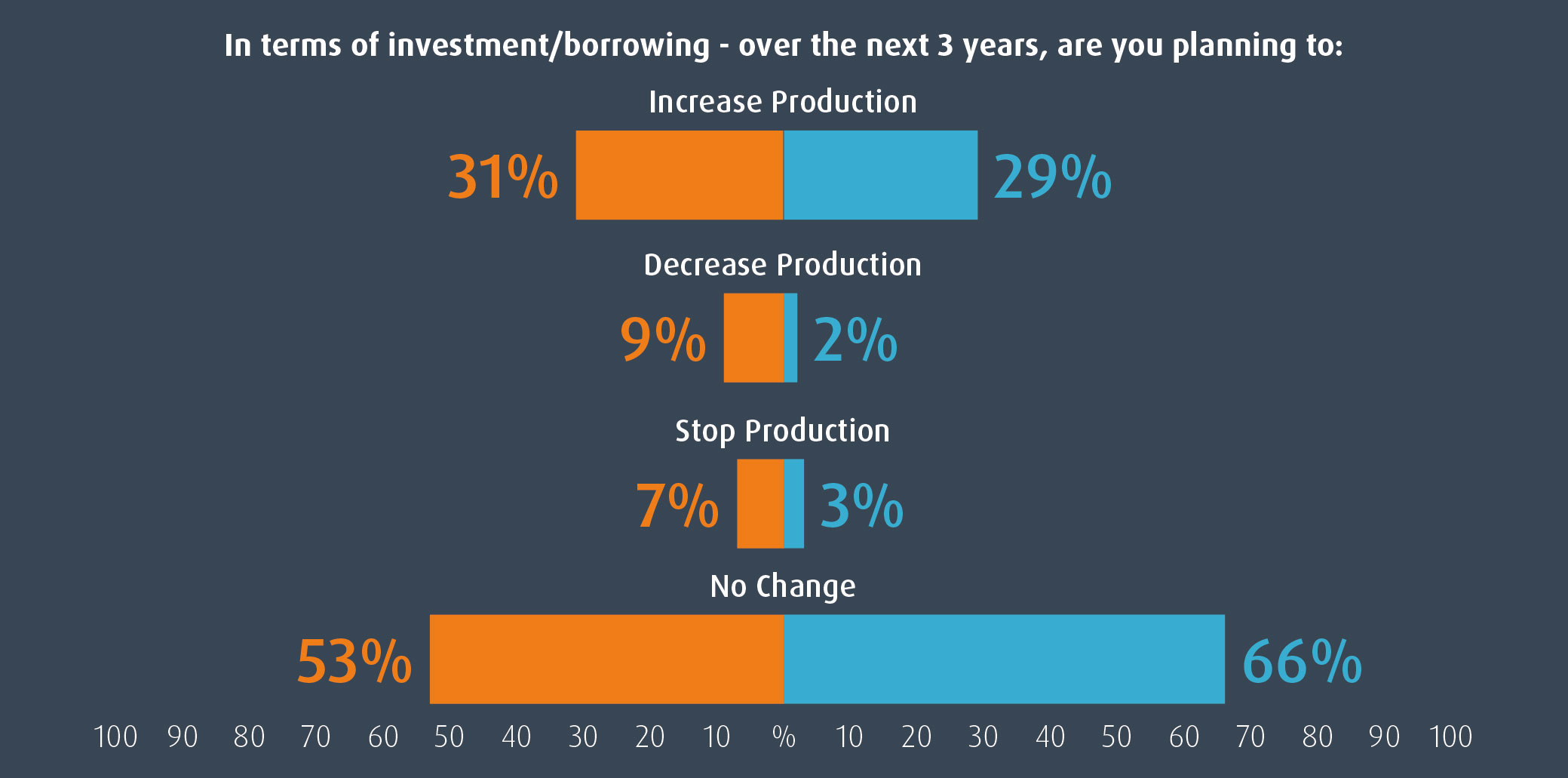

This improvement comes against the backdrop of a difficult recent period for UK egg producers, marked by avian influenza disruption, volatile feed and energy costs, labour pressures and sustained debate around standards, imports and regulation. Against that context, the fact that confidence has edged upwards at all is notable. It suggests that producers, while far from complacent, see greater stability ahead than they did a year ago, and perhaps feel that the worst of recent shocks may be behind them.That cautious improvement in outlook is reflected in production intentions, though not in a way that points to rapid growth. In 2026, just under 30 percent of respondents said they plan to increase production over the next three years, a slight dip compared with 2025. However, this marginal fall masks a much more significant shift elsewhere in the data. The proportion of producers planning to reduce production fell sharply year on year, from around one in ten in 2025 to fewer than two percent in 2026. Similarly, the share of respondents expecting to stop producing eggs altogether dropped from seven percent to just two and a half percent.

Over the next three years, most producers plan no change to production levels, with a higher proportion in 2026 (blue) showing stability. Intentions to increase production remain similar year on year, while fewer producers in 2026 (blue) expect to decrease or stop production compared with 2025 (orange).

The biggest movement is found among those planning no change. Two thirds of producers in 2026 said they expect to maintain current production levels, compared with just over half the year before. Taken together, these figures paint a picture of a sector that is no longer bracing for contraction, but which remains hesitant about expansion. For many producers, the message appears to be one of consolidation rather than growth, focusing on making existing systems work efficiently rather than committing to new sheds, new borrowing or increased bird numbers.This wait and see stance makes sense when viewed alongside producer concerns around policy, regulation and trade. Concern about government regulation remains high, with average scores in 2026 indicating a clear tilt towards the worried end of the scale. When the differently worded and oppositely scaled 2025 results are converted to allow comparison, overall concern appears broadly similar across the two years, with perhaps a slight easing in 2026. That said, regulation continues to loom large in producers’ minds, and remains one of the dominant factors shaping confidence and decision making.Alongside regulation, imports and trade deals emerge in 2026 as a major source of unease. Producers rate their concern about imports at a high level, with a median score of eight out of ten. This reflects long standing anxiety about the potential for lower standard egg and egg product imports to undercut UK production, particularly in the context of trade agreements that may prioritise price over equivalence of welfare and production standards. For a sector that has invested heavily in free range systems and higher welfare outcomes, the risk of being undercut by cheaper imports remains a powerful brake on confidence.

While these questions were not asked last year, the direction of travel makes it unsurprising that producers rated imports as the most significant concern, followed by government regulation. As this is new data, the colour scheme is not relevant in this instance.

Animal rights activism sits slightly lower on the list of concerns, but still above neutral. Producers’ responses suggest this is a persistent background pressure rather than an acute driver of change, contributing to stress and uncertainty but rarely acting alone as a trigger for investment or exit decisions. Planning permission, meanwhile, reveals a strikingly divided picture. On average, producers rate planning as close to neutral in terms of holding their business back, but the very wide spread of responses indicates that for some, planning remains a serious barrier, while for others it is barely an issue at all. This divergence suggests that targeted improvements in planning processes could unlock investment for a subset of producers, even if it would not transform sentiment across the board.What emerges overall is a portrait of an industry that is regaining its balance. Confidence is higher than it was a year ago, particularly when producers look beyond the immediate term, and the sharp fall in those planning to reduce or exit production is encouraging. At the same time, the dominance of “no change” responses underlines that this is not a sector ready to charge ahead. Instead, producers appear focused on resilience, cost control and risk management, keeping powder dry until there is greater clarity on regulation, trade and longer term policy direction.For the UK egg sector in 2026, confidence is therefore best described as cautious but constructive. The mood is no longer defensive, but neither is it exuberant. If stability in input costs continues and policy signals become clearer, this underlying improvement in sentiment could yet translate into renewed investment. For now, however, the message from producers is clear: confidence is rebuilding, but patience remains the order of the day.