Confidence survey provides insight into members’ intentions

Published on : 14 Apr 2025

Many of the topics included in the survey were discussed at this year’s BFREPA Roadshows...

BFREPA has launched its first UK-wide confidence survey of members, with the aim of providing clear insights into future intentions and help prevent interruptions to supply.The survey was open to all producer members and ran throughout the first quarter of 2025 closing on 31 March. This ‘evened’ out any particular short-lived factor that could influence the responses meaning that, with over 200 responses, it is a comprehensive and robust view of the level of confidence amongst BFREPA members. The survey will be run annually in future years to build up a picture, over time, of confidence in the sector.Gary Ford, Head of Producer Engagement and Strategy for BFREPA commented “The results will be of interest not only to members but also the wider industry, as well as stakeholders such as retailers and government. The Government has made growth a key policy priority since it came to power and has committed to grow the UK economy. “The critical ingredient of growth is confidence – free range producers must have the confidence to both invest in their business and also to stay in egg production going forward. That is why this is a key and informative survey.“As the survey builds over subsequent years it should act as a tool for everyone throughout the supply chain to identify producer satisfaction long before any issues arise, as we recently encountered in 2022.The survey comprised of four key questions: The first two questions asked producers to rank their confidence over a one year and a three year period using a scale of 1-10. 1 being no confidence over the prescribed time frame, 10 being very confident. Question1: What score would you give your confidence in the egg sector over the next 12 months?The average answer given by the 219 respondents was 6.6.Question 2: What score would you give your confidence in the egg sector for the next 3 years?The average answer given by the 219 respondent was 5.6.Any score above 5 is a positive outlook with a score below 5 suggesting a negative outlook. It is no surprise that both short and medium term confidence for the sector is positive and that the score for the three year outlook is slightly below the more immediate one year period. What is perhaps surprising is that the score for the next 12 months was not higher given how the sector has bounced back over the past eighteen months or so. The fact that it isn’t is perhaps a reflection of the ongoing avian flu outbreak (with 62 cases since 1st October at the time of writing), and the concern that this is causing free range producers. Given that there has been a number of cases in layers during the current outbreak, this has left producers worried and feeling ‘vulnerable’. The lack of insurance cover for many producers has exacerbated the situation.In addition, there may be some negative ‘legacy’ feeling from the margin crisis of 2022/23 that will still be very fresh in many producer’s minds.

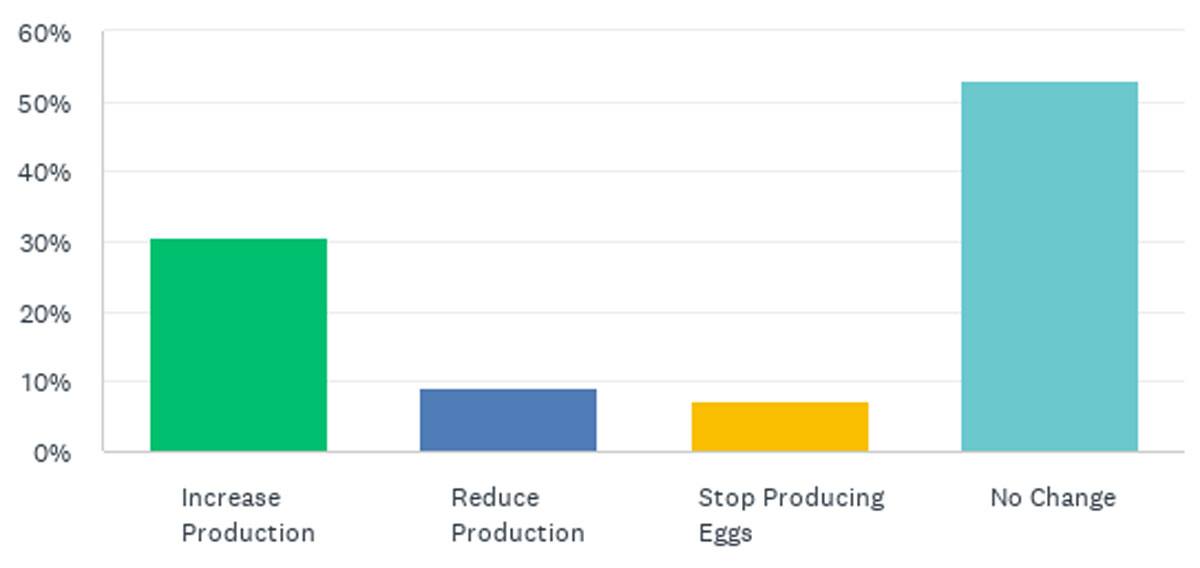

Question 3: In terms of investment/borrowing - over the next three years, are you planning to:

Question 3 focussed on investment as a proxy for growth and asked ‘In terms of investment / borrowing over the next 3 years, are you planning to:• Increase production• Reduce production• Stop production• No changeThe majority of the 219 respondents (53%) indicated ‘no change’. 31% indicated that they were planning to increase production; 9% reduce production and 7% stop production. The 16% that are either going to reduce or stop production is a concern and merits further investigation. It may well have been a decision that had previously been made during the ‘margin crisis’ period. Age of the owner / operator and succession may however, be the main reason behind this decision for many. Finally, the 4th question referenced some of the obstacles to growth in the sector. Members were asked ‘On a scale of 1-10 (1 being very concerned, 5 being neutral, and 10 being not concerned), what impact do you think regulation and legislation might have on your business over the next 12 months, if any?’:The average score recorded across the 219 respondents was 3.6 which, based on this scale is disappointing and represents a drag on confidence and potentially growth in the sector. Clearly price is not always the primary concern for our members. Recent changes in the budget around inheritance tax will have knocked some producer’s confidence in investing in the sector. Some will have found it challenging to comply with changes in assurance scheme rules. In addition, increasing concern around environmental issues and regulation as well as the difficulty and uncertainty – and significant cost - around planning permission are all likely to be factors that have played a part in this. "Margins have recovered from the low point of 2022, thanks in part to BFREPA's advocacy, and consequently confidence is strong in the short term and to a degree, longer-term. There are however concerns around regulation and legislation which will be having an impact on confidence and possibly a factor in those planning to exit the industry. This aspect of the survey will need addressing to prevent a future crisis," Gary added.